QuickBooks UK is a popular accounting software solution designed specifically for businesses operating in the United Kingdom. It offers a comprehensive suite of features and functionalities to streamline financial management, from tracking income and expenses to generating reports and managing payroll.

Table of Contents

Whether you’re a self-employed individual, a small business owner, or a larger enterprise, QuickBooks UK provides the tools and resources you need to stay organized, efficient, and compliant with UK regulations. With its user-friendly interface and intuitive design, QuickBooks UK simplifies accounting tasks, allowing you to focus on growing your business.

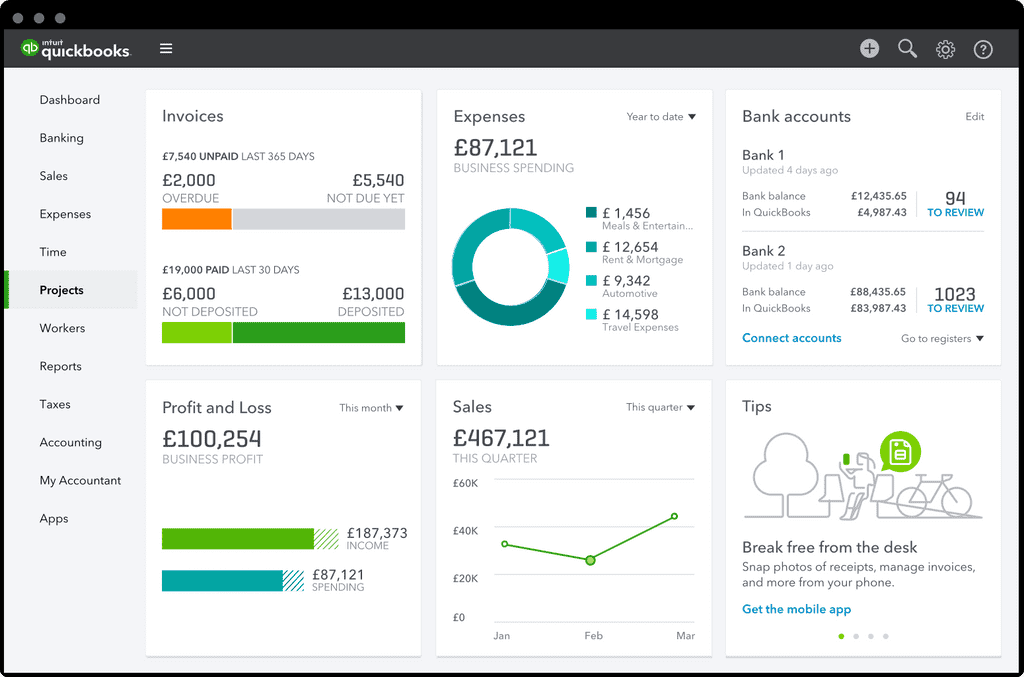

QuickBooks UK Overview

QuickBooks UK is a popular accounting software designed for small and medium-sized businesses in the UK. It provides a range of features to help businesses manage their finances, from basic bookkeeping to more advanced tasks like payroll and inventory management.

History and Evolution

QuickBooks UK was first launched in the UK in 1998, as a localized version of the popular QuickBooks software already available in the United States. Since then, the software has undergone several updates and improvements, incorporating new features and functionalities to meet the evolving needs of UK businesses. The software has adapted to changes in UK tax laws, regulations, and business practices, ensuring its relevance and usability for local businesses.

Key Features and Functionalities, Quickbooks uk

QuickBooks UK offers a wide range of features to cater to the needs of various businesses. These include:

- Invoicing and Sales Tracking: QuickBooks UK allows businesses to create professional invoices, track sales, and manage customer accounts.

- Expense Management: The software helps businesses track their expenses, categorize them, and generate reports for analysis.

- Bank Reconciliation: QuickBooks UK facilitates easy bank reconciliation by automatically importing bank statements and matching transactions.

- Inventory Management: For businesses that sell products, QuickBooks UK provides inventory tracking, purchase order management, and stock control features.

- Payroll: QuickBooks UK offers payroll processing capabilities, allowing businesses to pay their employees accurately and on time, while adhering to UK tax regulations.

- Reporting: QuickBooks UK generates a variety of financial reports, including profit and loss statements, balance sheets, and cash flow statements, providing valuable insights into business performance.

Target Audience

QuickBooks UK is designed for a wide range of businesses in the UK, including:

- Sole traders and freelancers: QuickBooks UK provides a simple and affordable solution for managing finances for self-employed individuals.

- Small businesses: The software offers a comprehensive set of features to meet the needs of growing businesses.

- Medium-sized businesses: QuickBooks UK can be scaled to handle the complexities of larger organizations.

QuickBooks UK is suitable for businesses across various industries, including:

- Retail: The software helps retail businesses manage inventory, track sales, and analyze customer data.

- Services: QuickBooks UK provides tools for service-based businesses to manage projects, track time, and generate invoices.

- Manufacturing: The software helps manufacturers manage inventory, track production costs, and analyze profitability.

- Construction: QuickBooks UK supports construction businesses in managing projects, tracking expenses, and generating reports.

QuickBooks UK Editions and Pricing

QuickBooks UK offers a range of editions to cater to different business needs and budgets. Each edition provides a unique set of features and functionalities, making it essential to choose the edition that best aligns with your business requirements.

QuickBooks UK Editions and Their Features

The following table compares the different editions of QuickBooks UK, outlining their key features and pricing structures:

| Edition | Features | Monthly Subscription | Annual Subscription |

|---|---|---|---|

| Self-Employed |

|

£12.50 | £125 |

| Simple Start |

|

£22 | £220 |

| Essentials |

|

£36 | £360 |

| Plus |

|

£50 | £500 |

QuickBooks UK for Different Business Needs

QuickBooks UK is a versatile accounting software that can cater to the needs of businesses of all sizes and industries. Its comprehensive features allow you to manage various aspects of your business, from tracking income and expenses to managing inventory and payroll.

Tracking Income and Expenses

Tracking income and expenses is crucial for any business to understand its financial health and make informed decisions. QuickBooks UK provides a user-friendly interface for recording transactions, categorizing them, and generating reports to analyze your financial performance.

- Automatic bank feeds: QuickBooks UK can automatically import transactions from your bank accounts, eliminating the need for manual data entry and reducing the risk of errors. This saves you time and effort while ensuring accurate financial records.

- Customizable expense tracking: You can categorize your expenses by type, project, or customer, allowing you to gain valuable insights into where your money is going. This information can help you identify areas where you can save money or make more informed spending decisions.

- Detailed financial reports: QuickBooks UK provides a range of customizable reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide a clear picture of your business’s financial performance and help you make informed decisions about your operations.

Managing Inventory

For businesses that sell products, managing inventory effectively is essential to avoid stockouts, minimize waste, and maximize profits. QuickBooks UK offers robust inventory management features to help you track your stock levels, monitor sales, and manage your supply chain.

- Real-time inventory tracking: QuickBooks UK provides real-time visibility into your inventory levels, allowing you to make informed decisions about ordering, production, and pricing. This helps you avoid stockouts and ensure that you have enough inventory to meet customer demand.

- Automated purchase orders: QuickBooks UK can automate the process of creating and sending purchase orders to suppliers, streamlining your procurement process and reducing the risk of errors. This helps you manage your inventory levels efficiently and avoid unnecessary expenses.

- Detailed inventory reports: QuickBooks UK provides a variety of reports, such as inventory valuation reports, sales by item reports, and stock turnover reports. These reports provide valuable insights into your inventory performance and help you identify areas for improvement.

Creating Invoices and Sending Reminders

Invoicing is an essential part of any business, and QuickBooks UK simplifies the process of creating, sending, and tracking invoices. The software provides tools to create professional invoices, track payments, and send automated reminders to customers who are overdue on their payments.

- Customizable invoice templates: QuickBooks UK offers a range of customizable invoice templates that you can use to create professional invoices that reflect your brand. You can include your company logo, contact information, and payment terms on your invoices.

- Automated invoice reminders: QuickBooks UK can automatically send reminders to customers who are overdue on their payments, helping you reduce late payments and improve your cash flow. You can customize the frequency and content of these reminders.

- Online payment processing: QuickBooks UK integrates with various online payment gateways, allowing your customers to pay their invoices online. This reduces the risk of lost or delayed payments and improves your cash flow.

Generating Financial Reports

Financial reports provide valuable insights into your business’s performance and help you make informed decisions. QuickBooks UK offers a wide range of customizable reports that can be used to track your income and expenses, analyze your profitability, and monitor your cash flow.

- Profit and loss statements: This report shows your business’s revenue and expenses over a specific period, allowing you to assess your profitability and identify areas where you can improve.

- Balance sheets: This report provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time. It helps you understand your financial position and assess your ability to meet your financial obligations.

- Cash flow statements: This report shows the movement of cash into and out of your business over a specific period. It helps you understand your cash flow patterns and identify potential cash flow issues.

Managing Payroll

Payroll is a complex and time-consuming task, and QuickBooks UK simplifies the process by providing a comprehensive payroll solution. The software allows you to calculate and pay employee wages, file taxes, and manage employee records.

- Automated payroll calculations: QuickBooks UK automatically calculates employee wages, deductions, and taxes, reducing the risk of errors and saving you time and effort. You can also set up direct deposit to pay your employees electronically.

- Tax filing: QuickBooks UK can help you file your payroll taxes with HMRC, ensuring that you comply with all legal requirements. The software also provides tools to track your payroll tax liabilities and ensure that you are making timely payments.

- Employee records management: QuickBooks UK allows you to store and manage employee records, such as contact information, payroll history, and tax information. This helps you maintain compliance with employment laws and regulations.

QuickBooks UK Integrations and Add-ons

QuickBooks UK offers a wide range of integration capabilities, allowing you to connect it with other essential business applications. These integrations streamline workflows, eliminate manual data entry, and provide a more comprehensive view of your business operations.

You can also leverage a variety of add-ons and extensions that expand the functionality of QuickBooks UK, tailoring it to meet your specific business needs.

Popular QuickBooks UK Integrations

Integrating QuickBooks UK with other applications can automate processes, improve data accuracy, and reduce the risk of errors. Here are some popular integrations:

- E-commerce Platforms: QuickBooks UK seamlessly integrates with popular e-commerce platforms like Shopify, Amazon, and eBay. This integration allows you to automatically import sales orders, manage inventory levels, and reconcile payments, simplifying your online business operations.

- Payment Gateways: QuickBooks UK integrates with leading payment gateways like Stripe, PayPal, and GoCardless. This integration facilitates online payments, automates payment processing, and provides real-time transaction updates, enhancing your cash flow management.

- CRM Systems: QuickBooks UK integrates with CRM systems like Salesforce, HubSpot, and Zoho CRM. This integration enables you to manage customer relationships, track sales pipelines, and generate detailed reports, improving customer engagement and sales performance.

- Project Management Tools: QuickBooks UK integrates with project management tools like Asana, Trello, and Monday.com. This integration allows you to track project progress, allocate resources, and manage tasks, improving project efficiency and collaboration.

- Accounting Software: QuickBooks UK integrates with other accounting software like Xero, Sage, and FreeAgent. This integration enables you to consolidate financial data, streamline reporting, and facilitate data exchange, simplifying your financial management.

Popular QuickBooks UK Add-ons

QuickBooks UK offers a range of add-ons that enhance its core functionality, addressing specific business needs. Here are some popular add-ons:

- Time Tracking: Time tracking add-ons like Toggl Track, Timely, and Clockify help you track employee time spent on projects, tasks, and clients. This data is crucial for accurate billing, performance evaluation, and resource allocation.

- Inventory Management: Inventory management add-ons like StockControl, Brightpearl, and Unleashed streamline inventory tracking, optimize stock levels, and automate purchase orders. This ensures you have the right products available at the right time, reducing stockouts and overstocking.

- Customer Relationship Management (CRM): CRM add-ons like Capsule CRM, Pipedrive, and Zoho CRM help you manage customer interactions, track sales opportunities, and automate marketing campaigns. This improves customer engagement, increases sales conversions, and strengthens customer loyalty.

- Reporting and Analytics: Reporting and analytics add-ons like Power BI, Tableau, and Google Data Studio provide advanced reporting and data visualization capabilities. These tools allow you to gain insights from your data, identify trends, and make data-driven decisions.

- E-commerce Integration: E-commerce integration add-ons like Shopify, Amazon, and eBay seamlessly connect your QuickBooks UK account to your online store. This streamlines order processing, inventory management, and payment reconciliation, simplifying your online business operations.

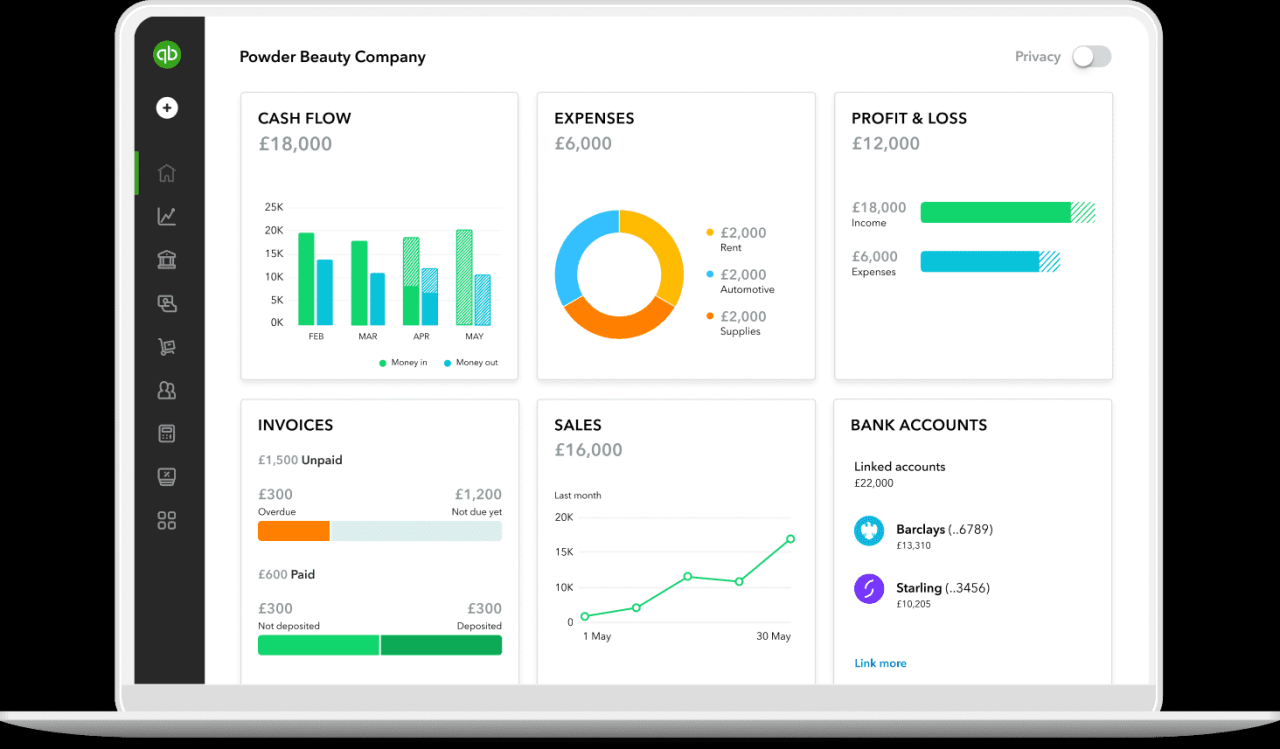

QuickBooks UK Mobile App

The QuickBooks UK mobile app allows you to manage your business finances on the go, providing a convenient and accessible way to stay connected with your business. This mobile app provides a comprehensive set of features that cater to various business needs, empowering users to perform essential tasks and gain valuable insights into their financial performance.

Key Features and Functionalities, Quickbooks uk

The QuickBooks UK mobile app offers a wide range of features that streamline financial management tasks, making it easier for users to stay organized and informed. Some of the key features include:

- Track Expenses: Capture receipts, categorize expenses, and monitor spending patterns to ensure financial discipline.

- Create and Send Invoices: Generate invoices quickly and easily, send them to customers, and track their payment status.

- Manage Customers and Suppliers: Add new contacts, view their details, and manage your business relationships effectively.

- Review Financial Reports: Access real-time insights into your business performance through reports such as profit and loss statements, balance sheets, and cash flow statements.

- Bank Reconciliation: Connect your bank accounts to automatically reconcile transactions, ensuring accurate financial records.

- Manage Payroll: (For QuickBooks Self-Employed users) Track your income and expenses, submit your Self Assessment tax return, and pay your taxes.

- Manage Inventory: (For QuickBooks Online users) Keep track of inventory levels, receive low-stock alerts, and manage stock movements.

Benefits of Using the QuickBooks UK Mobile App

The QuickBooks UK mobile app offers several benefits that enhance the efficiency and convenience of managing business finances.

- Accessibility: The app is available on both iOS and Android devices, allowing users to access their financial data anytime, anywhere.

- Real-time Insights: Users can monitor their business performance in real-time, providing immediate access to financial data and insights.

- Streamlined Processes: The app simplifies common financial tasks, such as tracking expenses, creating invoices, and reconciling bank accounts, saving time and effort.

- Improved Organization: The app helps users stay organized by providing a centralized platform for managing financial data, ensuring that all information is readily accessible.

- Enhanced Productivity: By automating tasks and providing real-time insights, the app helps users work more efficiently and productively.

Examples of Streamlining Business Processes

The QuickBooks UK mobile app can be used to streamline various business processes, improving efficiency and productivity.

- Expense Tracking: A freelancer can use the app to capture receipts for client meetings or business travel, categorize expenses, and track their spending, ensuring accurate record-keeping and tax compliance.

- Invoice Management: A small business owner can use the app to create invoices on the go, send them to customers immediately after completing a service, and track their payment status, ensuring timely payment collection.

- Inventory Management: A retailer can use the app to manage their inventory levels, receive low-stock alerts, and track stock movements, ensuring efficient inventory management and avoiding stockouts.

- Bank Reconciliation: A business owner can connect their bank accounts to the app to automatically reconcile transactions, ensuring accurate financial records and minimizing the risk of errors.

QuickBooks UK Customer Support

QuickBooks UK offers a comprehensive range of customer support options to assist users with their accounting needs. From self-service resources to direct communication with support agents, QuickBooks UK aims to provide timely and effective assistance to its users.

Customer Support Options

QuickBooks UK offers a variety of ways for users to access support, catering to different preferences and levels of urgency.

- Online Help Center: The QuickBooks UK Help Center is a vast repository of articles, tutorials, and FAQs covering a wide range of topics related to using QuickBooks UK. Users can search for specific information or browse through categories to find answers to their questions.

- Community Forum: The QuickBooks UK Community Forum allows users to connect with other QuickBooks UK users and share their experiences, ask questions, and seek advice from peers. This platform fosters a collaborative learning environment where users can learn from each other and find solutions to common challenges.

- Live Chat: For immediate assistance, QuickBooks UK offers live chat support. Users can connect with a support agent in real-time to get help with specific issues or queries. This option is ideal for urgent situations where a quick resolution is needed.

- Phone Support: QuickBooks UK provides phone support for users who prefer to speak directly with a support agent. This option allows for more in-depth discussions and personalized assistance, particularly for complex issues that require a more interactive approach.

- Email Support: Users can also contact QuickBooks UK support via email for non-urgent issues or inquiries. This option provides a written record of the conversation and allows users to gather their thoughts before reaching out for assistance.

Availability and Responsiveness

The availability and responsiveness of QuickBooks UK customer support vary depending on the chosen method of communication.

- Online Help Center: The Help Center is available 24/7, providing users with access to information whenever they need it. While the content is comprehensive, it may not always address every specific scenario, requiring users to seek further assistance.

- Community Forum: The Community Forum is active throughout the day, with responses from both QuickBooks UK staff and other users. The response time can vary depending on the complexity of the question and the activity level within the forum.

- Live Chat: Live chat support is generally available during business hours, offering real-time assistance to users. The wait time for a response can vary depending on the volume of inquiries.

- Phone Support: Phone support is typically available during business hours, with wait times varying depending on the time of day and the complexity of the issue.

- Email Support: Email support is available 24/7, but response times can vary depending on the volume of inquiries and the complexity of the issue. Users can expect a response within a reasonable timeframe, typically within 24-48 hours.

Self-Service Support Resources

QuickBooks UK provides a range of self-service support resources to empower users to find solutions independently.

- Help Center: As mentioned earlier, the Help Center is a valuable resource for users seeking information on a wide range of topics. It features articles, tutorials, and FAQs, covering everything from basic setup to advanced features. Users can search for specific information or browse through categories to find answers to their questions.

- Knowledge Base: The QuickBooks UK Knowledge Base is a collection of articles and resources that provide detailed information on various aspects of using QuickBooks UK. This resource is particularly helpful for users who prefer a more structured approach to learning and troubleshooting.

- Video Tutorials: QuickBooks UK offers a library of video tutorials that demonstrate various aspects of using the software. These tutorials are visually engaging and provide step-by-step instructions for common tasks and features. Users can access these tutorials through the Help Center or directly on the QuickBooks UK website.

- Community Forum: The Community Forum serves as a platform for users to share their experiences, ask questions, and learn from each other. This resource provides valuable insights and solutions from fellow QuickBooks UK users, offering a collaborative learning environment.

QuickBooks UK Security and Data Protection

Protecting your data is paramount, and QuickBooks UK takes security seriously. The platform employs robust measures to safeguard your financial information and ensure its confidentiality.

Data Encryption

QuickBooks UK uses industry-standard encryption protocols to protect your data both in transit and at rest. This means that your data is encrypted when it is being transmitted between your computer and QuickBooks servers, and it is also encrypted when it is stored on QuickBooks servers. This encryption helps to prevent unauthorized access to your data, even if someone were to intercept it.

Backup Protocols

QuickBooks UK automatically backs up your data on a regular basis. These backups are stored in secure off-site locations, ensuring that your data is protected in the event of a disaster such as a fire, flood, or power outage. You can also manually back up your data at any time.

Compliance with Data Protection Regulations

QuickBooks UK complies with relevant data protection regulations, including the UK’s General Data Protection Regulation (GDPR). This means that QuickBooks UK has implemented appropriate technical and organizational measures to protect your personal data.

QuickBooks UK Alternatives

Choosing the right accounting software is crucial for any business, and QuickBooks UK is a popular option. However, it might not be the perfect fit for everyone. There are several other accounting software solutions available in the UK, each with its own strengths and weaknesses. This section explores some of the most popular alternatives to QuickBooks UK, comparing their features, pricing, and target audience to help you make an informed decision.

Comparison of Popular Alternatives

Here’s a comparison of popular accounting software alternatives to QuickBooks UK, outlining their key features, pricing, and target audience:

| Software | Key Features | Pricing | Target Audience |

|---|---|---|---|

| Xero | Cloud-based, real-time accounting, bank reconciliation, invoicing, inventory management, reporting, mobile app, integrations with third-party apps | Starts at £25 per month | Small to medium-sized businesses (SMBs), freelancers, and startups |

| Sage Business Cloud | On-premise and cloud-based options, accounting, invoicing, payroll, CRM, reporting, inventory management, project management | Starts at £10 per month | SMBs, enterprises, and organizations with complex needs |

| FreeAgent | Cloud-based accounting, invoicing, expense tracking, project management, time tracking, reporting, mobile app, integrations with third-party apps | Starts at £15 per month | Freelancers, contractors, and small businesses |

| KashFlow | Cloud-based accounting, invoicing, expense tracking, bank reconciliation, reporting, mobile app, integrations with third-party apps | Starts at £10 per month | SMBs and freelancers |

| Zoho Books | Cloud-based accounting, invoicing, expense tracking, bank reconciliation, inventory management, reporting, mobile app, integrations with third-party apps | Starts at £12 per month | SMBs and startups |

Pros and Cons of Alternatives

Each alternative to QuickBooks UK has its own advantages and disadvantages. Here’s a breakdown of the pros and cons of each:

Xero

- Pros: User-friendly interface, powerful features, excellent mobile app, extensive integrations with third-party apps.

- Cons: Can be expensive for larger businesses, limited reporting options compared to some alternatives.

Sage Business Cloud

- Pros: Comprehensive features, robust reporting capabilities, on-premise and cloud-based options, suitable for businesses with complex needs.

- Cons: Can be complex to use, expensive for small businesses, limited mobile app functionality.

FreeAgent

- Pros: Designed specifically for freelancers and small businesses, user-friendly interface, excellent time tracking and project management features, affordable pricing.

- Cons: Limited features for larger businesses, not as comprehensive as other alternatives.

KashFlow

- Pros: Simple and easy to use, affordable pricing, good for small businesses and freelancers, strong bank reconciliation features.

- Cons: Limited features compared to other alternatives, not as powerful for larger businesses, limited integrations.

Zoho Books

- Pros: Comprehensive features, user-friendly interface, affordable pricing, good for startups and small businesses, strong inventory management capabilities.

- Cons: Limited reporting options compared to some alternatives, not as widely used as other options, limited mobile app functionality.

QuickBooks UK for Startups and Small Businesses

Starting a new business can be an exciting and challenging journey. Managing finances effectively is crucial for success, and QuickBooks UK offers a comprehensive solution designed specifically for startups and small businesses. Whether you’re a sole trader, a limited company, or a partnership, QuickBooks UK provides the tools and features to streamline your accounting and financial management.

Key Considerations for Startups and Small Businesses

When choosing accounting software for your startup or small business, it’s essential to consider your specific needs and requirements. Here are some key factors to evaluate:

- Ease of Use: QuickBooks UK is known for its user-friendly interface, making it easy for even non-accountants to understand and use. The intuitive design and step-by-step guidance ensure a smooth learning curve.

- Scalability: As your business grows, your accounting software should be able to adapt. QuickBooks UK offers different editions to cater to various business sizes, ensuring you have the right features as your needs evolve.

- Cost-Effectiveness: Startups and small businesses need to be mindful of their expenses. QuickBooks UK offers flexible pricing plans to suit different budgets, with options for monthly subscriptions or annual payments.

- Mobile Accessibility: The ability to access your accounting data on the go is essential for modern businesses. QuickBooks UK provides a mobile app that allows you to manage your finances from anywhere, anytime.

- Customer Support: Reliable customer support is crucial for any business, especially during the early stages. QuickBooks UK offers various support options, including online resources, phone support, and email assistance.

Benefits of Using QuickBooks UK for Startups and Small Businesses

QuickBooks UK offers several advantages for startups and small businesses, including:

- Simplified Accounting: QuickBooks UK streamlines accounting tasks, making it easier to track income and expenses, generate invoices, and manage cash flow. This frees up your time to focus on other aspects of your business.

- Improved Financial Visibility: QuickBooks UK provides real-time insights into your financial performance, enabling you to make informed decisions based on accurate data. You can easily track key metrics like revenue, expenses, and profitability.

- Automated Tasks: QuickBooks UK automates repetitive tasks, such as invoice creation and bank reconciliation, saving you time and reducing the risk of errors. This allows you to focus on more strategic activities.

- Enhanced Collaboration: QuickBooks UK enables seamless collaboration with your accountant or bookkeeper, allowing them to access your financial data securely and provide timely advice.

- Compliance and Reporting: QuickBooks UK helps you stay compliant with tax regulations by providing tools for generating reports and filing tax returns. It also offers features for managing VAT and other compliance requirements.

Setting Up QuickBooks UK for a New Business

Setting up QuickBooks UK for your new business is a straightforward process. Here’s a step-by-step guide:

- Choose the Right Edition: Determine the edition of QuickBooks UK that best suits your business needs and budget. QuickBooks Self-Employed is suitable for sole traders, while QuickBooks Online is ideal for small businesses with multiple employees.

- Create an Account: Sign up for a QuickBooks UK account online. You’ll need to provide basic business information, such as your company name, address, and contact details.

- Set Up Your Chart of Accounts: Create a chart of accounts that accurately reflects your business structure and financial activities. This will help you categorize transactions and generate accurate financial reports.

- Add Customers and Suppliers: Enter details about your customers and suppliers, including their contact information, payment terms, and invoices. This will help you manage your accounts receivable and accounts payable.

- Start Tracking Transactions: Begin recording your business transactions, including sales, purchases, expenses, and payments. QuickBooks UK makes it easy to categorize transactions and track your cash flow.

- Reconcile Your Bank Accounts: Regularly reconcile your bank accounts with your QuickBooks UK records to ensure accuracy and identify any discrepancies.

- Generate Reports: Use QuickBooks UK’s reporting tools to generate financial statements, such as profit and loss statements, balance sheets, and cash flow statements. These reports will provide valuable insights into your business performance.

Ultimate Conclusion

In conclusion, QuickBooks UK offers a robust and comprehensive accounting solution for businesses of all sizes in the UK. Its user-friendly interface, extensive features, and integration capabilities make it a valuable tool for managing finances, streamlining operations, and achieving business goals. Whether you’re just starting out or have an established business, QuickBooks UK can help you stay on top of your finances and make informed decisions to drive growth.

QuickBooks UK is a powerful accounting software designed to streamline financial management for businesses of all sizes. One important aspect of ensuring the security of your financial data is having a robust antivirus solution like Windows Defender , which can help protect your QuickBooks data from malware threats.

By implementing a comprehensive security strategy, you can ensure that your QuickBooks UK data remains safe and secure.