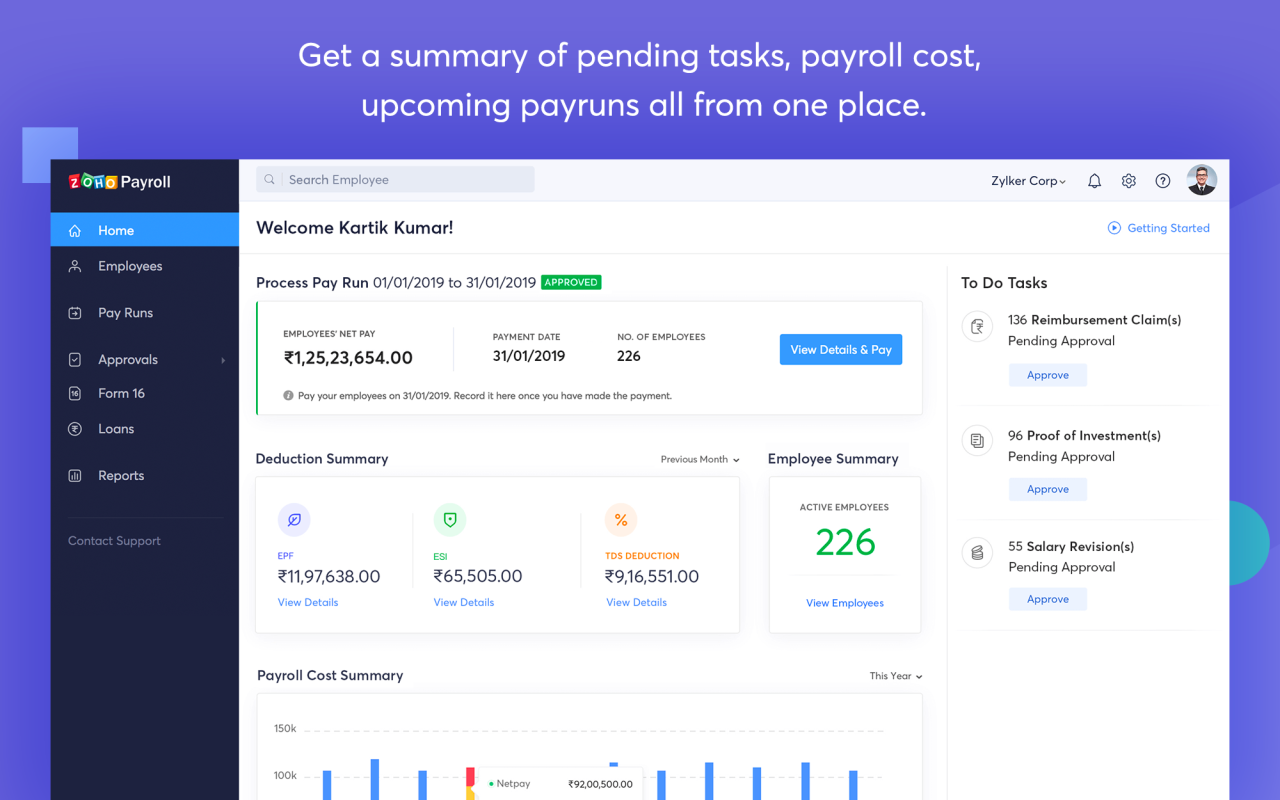

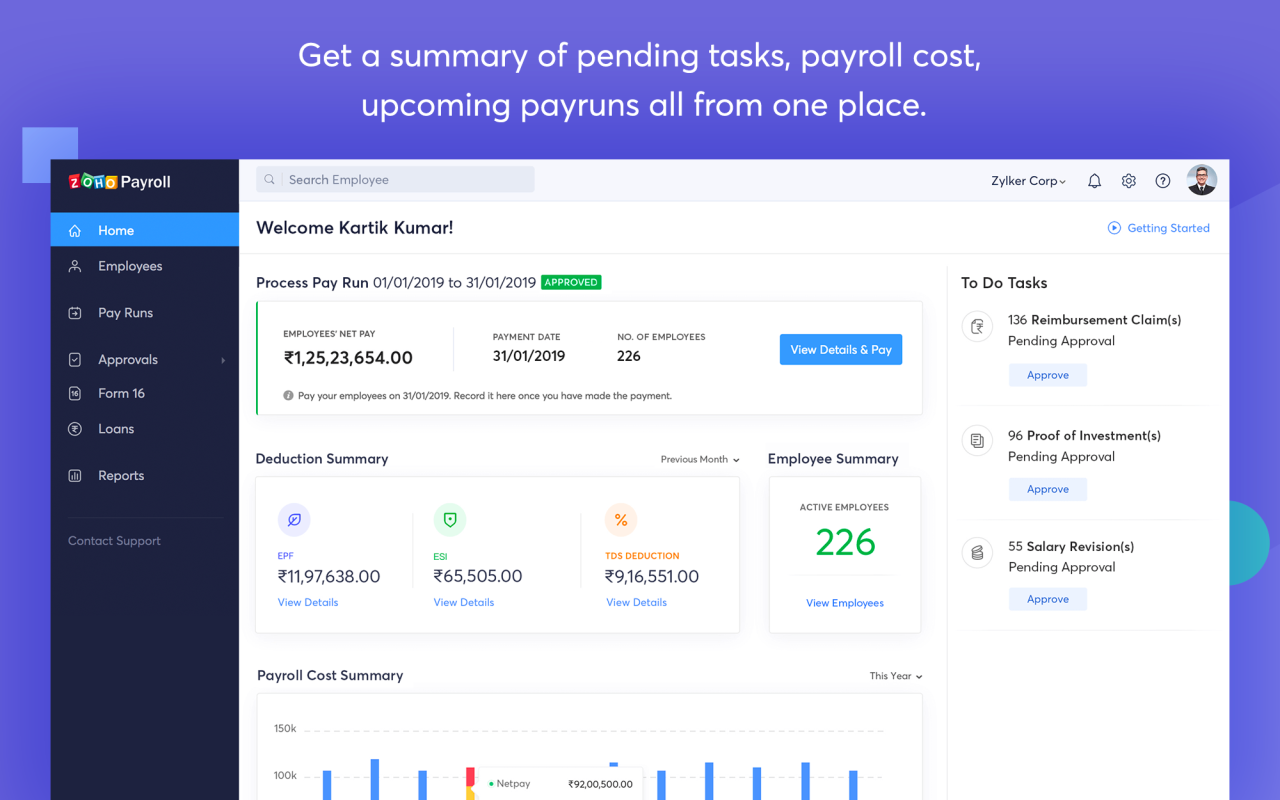

Zoho Payroll is a comprehensive payroll solution designed to simplify and automate payroll processes for businesses of all sizes. It offers a range of features and functionalities, from calculating and processing payroll to managing deductions and generating reports. Whether you’re a small startup or a large enterprise, Zoho Payroll aims to streamline your payroll operations and provide valuable insights into your workforce data.

Table of Contents

Zoho Payroll’s user-friendly interface and intuitive design make it easy to navigate and manage your payroll tasks. The platform integrates seamlessly with other Zoho applications, such as Zoho CRM and Zoho Books, providing a unified platform for managing your business operations. Zoho Payroll also ensures compliance with local and federal payroll regulations, giving you peace of mind knowing your payroll practices are compliant.

Zoho Payroll

Zoho Payroll is a comprehensive cloud-based payroll solution designed to streamline and simplify payroll processes for businesses of all sizes. It offers a wide range of features, from automated calculations and tax compliance to employee self-service and robust reporting.

Target Audience

Zoho Payroll is designed for businesses of all sizes, from small startups to large enterprises. It caters to a diverse range of industries, including manufacturing, retail, healthcare, and technology. The platform is particularly well-suited for businesses that are looking for a cost-effective and user-friendly payroll solution that can be easily integrated with other business applications.

History and Evolution

Zoho Payroll was launched in 2014 as part of Zoho’s suite of business applications. The platform has undergone significant evolution since its inception, with continuous updates and enhancements to meet the changing needs of businesses. Key milestones in its development include:

- 2014: Zoho Payroll is launched, offering basic payroll features such as salary calculation, tax deductions, and payslip generation.

- 2016: The platform is enhanced with advanced features such as employee self-service, direct deposit, and payroll reporting.

- 2018: Zoho Payroll introduces integrations with other Zoho applications, such as Zoho CRM and Zoho Recruit, to streamline business processes.

- 2020: The platform expands its reach to new markets, including Canada, Australia, and the United Kingdom.

- 2022: Zoho Payroll continues to innovate with features such as AI-powered payroll automation, mobile accessibility, and enhanced security.

Key Benefits of Zoho Payroll

Zoho Payroll is a comprehensive payroll solution that simplifies and streamlines the payroll process for businesses of all sizes. It offers a wide range of features and benefits, making it an ideal choice for businesses looking to improve efficiency, reduce costs, and ensure compliance.

Benefits for Businesses of Different Sizes

Zoho Payroll offers advantages for businesses of all sizes, from small startups to large enterprises.

- Small Businesses: Zoho Payroll simplifies payroll for small businesses by automating tasks, eliminating the need for manual calculations and reducing the risk of errors. It also helps small businesses stay compliant with labor laws and regulations.

- Medium-Sized Businesses: Zoho Payroll helps medium-sized businesses manage their growing workforce efficiently by providing features such as employee self-service portals, automated time and attendance tracking, and robust reporting tools. It also helps businesses manage benefits and deductions easily.

- Large Enterprises: Zoho Payroll provides large enterprises with a scalable and secure platform for managing payroll for a large number of employees across multiple locations. It offers advanced features such as integration with HR systems, customizable workflows, and comprehensive reporting capabilities.

Streamlining Payroll Processes and Reducing Administrative Burden

Zoho Payroll automates many payroll tasks, freeing up valuable time for businesses to focus on other critical aspects of their operations.

- Automated Calculations: Zoho Payroll automatically calculates payroll, including taxes, deductions, and net pay, eliminating the need for manual calculations and reducing the risk of errors.

- Time and Attendance Tracking: Zoho Payroll integrates with time and attendance systems, allowing businesses to track employee hours accurately and automatically generate payroll data.

- Employee Self-Service Portal: Employees can access their pay stubs, update their personal information, and submit time-off requests through a self-service portal, reducing administrative burden on HR staff.

- Compliance Management: Zoho Payroll helps businesses stay compliant with labor laws and regulations by providing features such as tax filing, wage and hour tracking, and reporting tools.

Cost Savings and Efficiency Gains

Zoho Payroll helps businesses save money and improve efficiency by automating tasks, reducing errors, and streamlining processes.

- Reduced Labor Costs: By automating payroll tasks, businesses can free up valuable time for HR staff, allowing them to focus on more strategic initiatives.

- Minimized Errors: Automated calculations and data entry reduce the risk of errors, which can save businesses money by avoiding costly penalties and rework.

- Improved Efficiency: Zoho Payroll’s streamlined processes and intuitive interface help businesses process payroll faster and more efficiently, reducing administrative overhead.

Features and Modules of Zoho Payroll

Zoho Payroll is a comprehensive payroll solution that streamlines payroll processes and automates tasks, making it easier for businesses of all sizes to manage their payroll efficiently. It offers a wide range of features and modules to meet the diverse needs of organizations.

Modules of Zoho Payroll

Zoho Payroll is designed to manage various aspects of payroll, offering a range of modules that cover different functionalities.

| Module | Key Functionalities |

|---|---|

| Employee Management | Adding, editing, and managing employee details, including personal information, employment history, and tax details. |

| Payroll Processing | Calculating salaries, deductions, and taxes, generating payslips, and making payments to employees. |

| Time and Attendance | Tracking employee attendance, leave requests, and overtime hours. |

| Benefits Management | Managing employee benefits, such as health insurance, retirement plans, and other perks. |

| Reporting and Analytics | Generating various payroll reports, including payslip summaries, tax reports, and employee earnings statements. |

| Compliance and Security | Ensuring compliance with local and federal labor laws, maintaining data security, and protecting sensitive employee information. |

Pricing Plans of Zoho Payroll

Zoho Payroll offers different pricing plans to cater to the varying needs and budgets of businesses.

| Plan | Features | Price |

|---|---|---|

| Basic | Core payroll features, employee management, and basic reporting. | $15 per month per employee |

| Standard | Includes all Basic plan features, plus time and attendance tracking, benefits management, and advanced reporting. | $25 per month per employee |

| Premium | Includes all Standard plan features, plus integrations with other Zoho applications, custom reporting, and dedicated support. | $35 per month per employee |

Integration Capabilities of Zoho Payroll

Zoho Payroll seamlessly integrates with other Zoho applications, such as Zoho CRM, Zoho People, and Zoho Books, to streamline business processes and eliminate data redundancy. This allows for a unified platform for managing various aspects of the business, including sales, HR, and accounting.

Zoho Payroll also integrates with popular third-party tools, such as QuickBooks, Xero, and Stripe, to facilitate seamless data exchange and automate workflows.

Payroll Compliance and Regulations

Navigating the complex world of payroll regulations can be daunting for businesses. Zoho Payroll is designed to simplify this process by offering a comprehensive suite of features that ensure compliance with local and federal regulations.

Compliance with Local and Federal Regulations

Zoho Payroll offers a range of features that help businesses stay compliant with payroll regulations. These features include:

- Automatic Tax Calculation and Filing: Zoho Payroll automatically calculates and files federal, state, and local taxes, ensuring accuracy and timely compliance.

- Real-Time Updates: Zoho Payroll’s system is continuously updated to reflect changes in tax laws and regulations. This ensures that businesses are always operating in compliance.

- Customizable Deductions: Zoho Payroll allows businesses to set up and manage a variety of deductions, including pre-tax deductions for healthcare and retirement plans. This ensures compliance with various deduction regulations.

- Reporting and Auditing: Zoho Payroll provides detailed reports and audit trails, which can be used to demonstrate compliance with regulations. This helps businesses to easily track and manage their payroll data.

Managing Payroll Taxes and Deductions

Zoho Payroll provides robust tools to manage payroll taxes and deductions accurately:

- Tax Rate Tables: Zoho Payroll utilizes up-to-date tax rate tables to ensure accurate calculation of federal, state, and local taxes. These tables are updated regularly to reflect changes in tax laws.

- Deduction Management: Businesses can easily set up and manage various deductions, including pre-tax deductions for healthcare and retirement plans, as well as post-tax deductions for things like charitable contributions.

- Tax Filing Integration: Zoho Payroll integrates with various tax filing services, streamlining the process of filing payroll taxes and ensuring accuracy.

- Reporting and Analysis: Zoho Payroll provides detailed reports on payroll taxes and deductions, allowing businesses to track their tax liabilities and identify potential savings opportunities.

Simplifying Payroll Reporting

Zoho Payroll simplifies the process of filing payroll reports:

- Pre-Built Reports: Zoho Payroll offers a variety of pre-built reports that can be used to meet various reporting requirements. These reports can be customized to meet specific business needs.

- Automated Report Generation: Zoho Payroll automates the generation of reports, saving businesses time and effort. This also helps to ensure that reports are accurate and timely.

- Electronic Filing: Zoho Payroll supports electronic filing of payroll reports, streamlining the process and reducing the risk of errors.

- Integration with Other Systems: Zoho Payroll integrates with other business systems, such as accounting software, allowing businesses to easily share payroll data and generate reports. This helps to simplify the reporting process and reduce the risk of errors.

Employee Self-Service and Time Tracking: Zoho Payroll

Zoho Payroll empowers employees to manage their payroll information and track their work hours efficiently, streamlining processes and improving overall productivity. This section delves into the self-service features offered by Zoho Payroll and explores how it seamlessly integrates with time tracking tools.

Employee Self-Service Features

Employee self-service features in Zoho Payroll provide employees with convenient access to their payroll information, allowing them to manage their details and stay informed about their earnings.

- View Payslips: Employees can access their payslips online, eliminating the need for paper copies and providing them with a clear record of their earnings and deductions.

- Update Personal Information: Employees can modify their personal information, such as address, bank details, and emergency contacts, ensuring accurate payroll processing.

- Submit Leave Requests: Employees can submit leave requests directly through the system, enabling managers to approve or deny requests efficiently.

- Track Leave Balances: Employees can view their remaining leave balances, helping them plan their time off effectively.

- Access Tax Forms: Employees can download tax forms and other relevant documents, simplifying tax compliance.

Time Tracking Integration

Zoho Payroll seamlessly integrates with various time tracking tools, providing a unified platform for managing both payroll and time records.

- Zoho Time: Zoho Time is Zoho’s dedicated time tracking tool, allowing employees to clock in and out, track their time on projects, and generate reports.

- Third-Party Integrations: Zoho Payroll supports integrations with other popular time tracking tools like Toggl, Clockify, and Timely, offering flexibility in choosing the best solution for your business.

Best Practices for Utilizing Employee Self-Service and Time Tracking

To maximize the benefits of employee self-service and time tracking features, consider the following best practices:

- Provide Clear Instructions: Offer comprehensive training and support materials to ensure employees understand how to use the self-service portal and time tracking tools effectively.

- Encourage Regular Use: Promote the use of self-service features by highlighting their benefits and encouraging employees to manage their payroll information independently.

- Monitor and Analyze Data: Regularly review data generated by time tracking tools to identify trends, improve productivity, and optimize resource allocation.

- Regularly Update and Enhance: Continuously update and improve your self-service portal and time tracking systems to meet evolving business needs and employee expectations.

Reporting and Analytics

Zoho Payroll provides a robust suite of reports and dashboards that empower businesses to gain valuable insights into their payroll data. These reports offer comprehensive visibility into payroll expenses, employee compensation, tax withholdings, and other critical financial metrics. By leveraging these analytics, businesses can make informed decisions, improve efficiency, and ensure compliance with payroll regulations.

Payroll Reports, Zoho payroll

Zoho Payroll offers a wide range of reports to cater to various needs. Here are some of the key reports available:

- Payroll Summary Report: Provides a consolidated view of payroll expenses, including gross pay, deductions, net pay, and taxes for a specific period. This report is essential for understanding overall payroll costs and identifying potential cost-saving opportunities.

- Employee Pay Slip Report: Displays detailed information about each employee’s pay, including earnings, deductions, and net pay. This report is essential for providing employees with accurate and transparent pay statements.

- Tax Withholding Report: Summarizes tax withholdings for each employee and for the entire organization. This report is crucial for ensuring compliance with tax regulations and filing accurate tax returns.

- Leave Report: Tracks employee leave balances and provides a detailed overview of leave taken and remaining leave days. This report helps monitor employee leave usage and manage leave policies effectively.

- Time Tracking Report: Provides insights into employee work hours, overtime, and other time-related data. This report is essential for managing employee time and ensuring accurate payroll calculations.

Analyzing Payroll Data for Business Insights

Businesses can leverage reporting and analytics to gain valuable insights into their payroll data, which can inform strategic decision-making and improve operational efficiency.

- Identifying Payroll Cost Trends: Analyzing payroll summary reports over time can reveal trends in payroll expenses. This information can help businesses identify areas where they can reduce costs, such as negotiating with vendors for lower rates or implementing cost-saving measures.

- Evaluating Employee Compensation: Comparing employee pay data with industry benchmarks can help businesses ensure that their compensation packages are competitive. This information can also identify potential salary discrepancies and guide compensation adjustments.

- Optimizing Time Management: Time tracking reports can help businesses identify inefficiencies in employee time utilization. By analyzing employee work patterns, businesses can optimize scheduling, allocate resources more effectively, and improve overall productivity.

- Monitoring Compliance: Payroll compliance reports can help businesses track tax withholdings, ensure compliance with labor laws, and prevent potential penalties. This is crucial for maintaining a strong legal and financial standing.

Using Reports for Decision-Making and Performance Management

Reports and dashboards can play a vital role in performance management and decision-making within an organization.

- Performance Reviews: Employee pay slip reports can provide valuable data for performance reviews. By comparing employee earnings and performance metrics, managers can assess individual contributions and identify areas for improvement.

- Budgeting and Forecasting: Payroll summary reports can be used to create accurate budgets and forecasts for future payroll expenses. This information is essential for financial planning and resource allocation.

- Strategic Planning: Analyzing payroll data can help businesses identify areas for improvement in employee benefits, compensation, and other HR-related initiatives. This data can guide strategic decisions and improve employee satisfaction.

- Talent Acquisition: Payroll reports can help businesses track employee turnover and identify potential recruitment challenges. This information can guide talent acquisition strategies and improve employee retention.

Security and Data Protection

Zoho Payroll understands that payroll data is highly sensitive and requires robust security measures to protect it from unauthorized access, breaches, and data loss. The platform implements a comprehensive approach to data security, encompassing encryption, access controls, compliance certifications, and regular security audits.

Data Encryption

Zoho Payroll utilizes industry-standard encryption technologies to safeguard sensitive payroll data at rest and in transit. This means that all data, including employee information, salaries, tax details, and bank account information, is encrypted using advanced algorithms, making it unreadable to unauthorized individuals.

Access Control

Zoho Payroll employs a multi-layered access control system to ensure that only authorized personnel can access payroll data. This system includes:

- Role-based access control (RBAC): This system assigns different levels of access to different users based on their roles and responsibilities within the organization. For example, HR managers may have full access to payroll data, while employees may only be able to view their own pay stubs.

- Two-factor authentication (2FA): This adds an extra layer of security by requiring users to provide two forms of authentication, such as a password and a code sent to their mobile device, before accessing the system. This effectively prevents unauthorized access even if someone obtains a user’s password.

- Audit trails: Zoho Payroll maintains detailed audit trails of all user activity, including data access, modifications, and deletions. This allows administrators to track user actions and identify any suspicious activity.

Compliance Certifications and Standards

Zoho Payroll is committed to meeting industry-standard security and compliance certifications, demonstrating its commitment to data protection and security. The platform adheres to the following:

- ISO 27001: This international standard for information security management systems ensures that Zoho Payroll implements robust security controls to protect sensitive data.

- SOC 2 Type II: This certification verifies that Zoho Payroll meets rigorous security, availability, processing integrity, confidentiality, and privacy controls. This certification provides assurance to customers that the platform has implemented strong security measures to protect their data.

- GDPR (General Data Protection Regulation): Zoho Payroll complies with the GDPR, a comprehensive data protection regulation in the European Union. This ensures that personal data is processed lawfully, fairly, and transparently, and that appropriate technical and organizational measures are in place to protect the data.

Customer Support and Resources

Zoho Payroll prioritizes providing its users with comprehensive support and resources to ensure a smooth and efficient payroll experience. Zoho offers various support channels, online resources, and training materials to assist users with any questions or challenges they may encounter.

Customer Support Options

Zoho Payroll provides several customer support options to cater to the diverse needs of its users.

- Email Support: Users can reach out to Zoho Payroll’s dedicated support team via email for assistance with various issues, including account setup, payroll processing, and compliance-related questions.

- Phone Support: For urgent inquiries or situations requiring immediate assistance, users can contact Zoho Payroll’s phone support line. This option offers direct communication with a support representative for prompt resolution.

- Live Chat: Zoho Payroll provides a live chat feature on its website, allowing users to connect with a support agent in real-time. This option is particularly helpful for quick answers to general questions or troubleshooting minor issues.

- Help Center: Zoho Payroll’s extensive help center serves as a comprehensive knowledge base, providing detailed articles, FAQs, and tutorials covering a wide range of topics. This resource is valuable for self-service support and finding solutions to common problems.

Knowledge Base and Documentation

Zoho Payroll’s knowledge base and documentation offer a wealth of information for users to access at their convenience.

- User Guides: Zoho Payroll provides comprehensive user guides that walk users through the various features and functionalities of the platform. These guides are designed to be easy to understand and navigate, making it simple for users to learn how to use the system effectively.

- FAQs: Zoho Payroll’s frequently asked questions (FAQs) section addresses common user queries, providing quick and concise answers to frequently encountered issues. This resource helps users find solutions quickly and efficiently.

- Tutorials: Zoho Payroll offers a variety of tutorials and video guides that demonstrate how to perform specific tasks within the platform. These tutorials are helpful for users who prefer a visual learning experience and want to see real-time demonstrations of how to use the software.

- Blog: Zoho Payroll’s blog regularly publishes articles and insights on payroll-related topics, providing valuable information and updates for users. This resource helps users stay informed about industry trends and best practices.

Training Resources

Zoho Payroll understands the importance of providing users with adequate training to ensure they can utilize the platform effectively.

- Online Training Courses: Zoho Payroll offers a range of online training courses that cover various aspects of the platform, from basic setup to advanced features. These courses provide a structured learning experience and are accessible at any time.

- Webinars: Zoho Payroll regularly hosts webinars on various payroll-related topics, offering valuable insights and practical advice for users. These webinars are a great way for users to learn from experts and ask questions in real-time.

- Community Forums: Zoho Payroll provides a dedicated community forum where users can connect with each other, share experiences, and ask questions. This forum is a valuable resource for users to learn from peers and find solutions to common problems.

Issue Resolution Process

Zoho Payroll has a streamlined process for resolving user issues and seeking assistance.

- Submit a Support Ticket: Users can submit a support ticket through Zoho Payroll’s website, providing detailed information about the issue they are facing. This allows the support team to understand the problem and provide a tailored solution.

- Escalation Process: If an issue cannot be resolved through initial support channels, users can escalate their case to a higher level of support. This ensures that complex or urgent issues receive prompt attention and resolution.

- Follow-up and Feedback: Zoho Payroll encourages users to provide feedback on their support experience. This feedback is valuable for improving the quality and efficiency of the support process.

Case Studies and Success Stories

Zoho Payroll has helped businesses of all sizes streamline their payroll processes and achieve significant improvements in efficiency, accuracy, and compliance. Here are some real-world examples of how businesses have benefited from using Zoho Payroll.

Benefits Realized by Businesses Using Zoho Payroll

Businesses using Zoho Payroll have reported numerous benefits, including:

- Reduced Payroll Processing Time: Zoho Payroll automates many payroll tasks, such as calculating taxes, deductions, and net pay, freeing up HR professionals to focus on other important tasks. This has resulted in significant time savings for many businesses.

- Improved Accuracy: Zoho Payroll’s built-in calculations and validations help ensure that payroll is processed accurately. This reduces the risk of errors and costly corrections.

- Enhanced Compliance: Zoho Payroll keeps businesses up-to-date on the latest payroll regulations and tax laws. This helps businesses avoid costly penalties and fines.

- Increased Employee Satisfaction: Zoho Payroll’s self-service features allow employees to access their pay stubs, tax information, and other payroll-related documents online. This convenience and transparency can improve employee satisfaction.

- Cost Savings: Zoho Payroll can help businesses save money on payroll processing costs by eliminating the need for manual tasks and reducing the risk of errors. This can free up budget for other important business needs.

Examples of Businesses That Have Successfully Implemented Zoho Payroll

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] was struggling with manual payroll processing. They were spending [Time] each month on payroll, and errors were frequent. After implementing Zoho Payroll, [Business Name] reduced its payroll processing time by [Percentage] and eliminated errors. The company also saved [Amount] annually in payroll processing costs.

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] needed a solution to manage payroll for its employees in multiple locations. Zoho Payroll’s ability to handle multiple locations and currencies made it the ideal solution. [Business Name] was able to streamline its payroll process and improve compliance with local regulations.

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] was looking for a way to improve employee self-service. Zoho Payroll’s employee self-service portal gave employees access to their pay stubs, tax information, and other payroll-related documents online. This improved employee satisfaction and reduced the workload on HR.

Case Studies of Businesses Using Zoho Payroll

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] was struggling with manual payroll processing. They were spending [Time] each month on payroll, and errors were frequent. After implementing Zoho Payroll, [Business Name] reduced its payroll processing time by [Percentage] and eliminated errors. The company also saved [Amount] annually in payroll processing costs.

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] needed a solution to manage payroll for its employees in multiple locations. Zoho Payroll’s ability to handle multiple locations and currencies made it the ideal solution. [Business Name] was able to streamline its payroll process and improve compliance with local regulations.

- [Business Name]: A [Industry] company with [Number] employees, [Business Name] was looking for a way to improve employee self-service. Zoho Payroll’s employee self-service portal gave employees access to their pay stubs, tax information, and other payroll-related documents online. This improved employee satisfaction and reduced the workload on HR.

Comparison with Competitors

Zoho Payroll is a robust and feature-rich payroll solution that competes with other leading payroll software providers. Understanding the strengths and weaknesses of each platform is crucial for businesses to choose the best fit for their needs. This section will compare and contrast Zoho Payroll with its competitors, highlighting key differentiators and competitive advantages.

Comparison with Leading Payroll Software Solutions

This section will delve into the key differences between Zoho Payroll and its prominent competitors, such as ADP, Paychex, Gusto, and QuickBooks Payroll. Each competitor offers a unique set of features, pricing models, and target markets.

- ADP: A large and established player in the payroll industry, ADP offers a comprehensive suite of payroll, HR, and benefits solutions. Its strengths lie in its extensive features, industry-leading compliance support, and robust integrations. However, ADP’s pricing can be expensive, especially for smaller businesses.

- Paychex: Similar to ADP, Paychex provides a wide range of payroll and HR services. It excels in its user-friendly interface, strong customer support, and comprehensive compliance tools. Paychex is known for its flexible pricing plans, catering to various business sizes.

- Gusto: Gusto is a popular choice for startups and small businesses. Its intuitive interface, affordable pricing, and focus on employee experience make it attractive. Gusto offers integrated features for benefits, PTO tracking, and HR management. However, it may lack some advanced features compared to larger platforms like ADP and Paychex.

- QuickBooks Payroll: QuickBooks Payroll is a well-known payroll solution integrated with the popular QuickBooks accounting software. It offers seamless integration with QuickBooks, simplifying financial management. QuickBooks Payroll is suitable for small businesses with basic payroll needs and those already using QuickBooks.

Key Differentiators and Competitive Advantages of Zoho Payroll

Zoho Payroll distinguishes itself from competitors through its focus on integration with the Zoho ecosystem, comprehensive features, and affordable pricing.

- Integration with Zoho Ecosystem: Zoho Payroll seamlessly integrates with other Zoho applications, such as CRM, HR, and accounting software. This integration streamlines business processes, reduces data redundancy, and enhances efficiency.

- Comprehensive Features: Zoho Payroll offers a wide range of features, including payroll processing, tax filing, direct deposit, employee self-service, time tracking, reporting, and analytics. It caters to the needs of businesses of all sizes and industries.

- Affordable Pricing: Compared to some of its competitors, Zoho Payroll offers competitive pricing plans, making it accessible to businesses with limited budgets. Its tiered pricing structure allows businesses to choose a plan that aligns with their specific requirements.

Pros and Cons of Different Payroll Software Options

The best payroll software solution depends on the specific needs of a business. Here is a breakdown of the pros and cons of different options:

| Payroll Software | Pros | Cons |

|---|---|---|

| Zoho Payroll |

|

|

| ADP |

|

|

| Paychex |

|

|

| Gusto |

|

|

| QuickBooks Payroll |

|

|

Final Summary

Zoho Payroll empowers businesses to manage their payroll efficiently and effectively, freeing up time and resources to focus on other critical aspects of their operations. By leveraging the platform’s comprehensive features, businesses can streamline their payroll processes, reduce administrative burden, and gain valuable insights into their workforce data. Whether you’re looking to automate your payroll, improve compliance, or enhance employee self-service, Zoho Payroll provides a powerful solution to meet your needs.

Zoho Payroll is a great tool for managing employee paychecks and benefits. But sometimes, you might need a more visual way to explain complex payroll processes to your team. That’s where videoscribe comes in. This tool allows you to create engaging animated videos that can easily illustrate even the most complicated payroll procedures, making them easier for everyone to understand.

With Zoho Payroll and videoscribe, you can streamline your payroll operations and improve communication with your employees.